So, Your Cheap level premium Term Life Insurance policy Is About To Go Up 10x At Your Renewal.

Level premium term life insurance policies ideally last as long as principal financial obligations, such as a mortgage or the costs of raising children. But sometimes things don’t work out that way.

If your cheap level premium term life insurance policy is ending, you may still need life insurance protection if you:

- Have house payments

- Owe other major debts

- Have children who are still dependent on you

- Have a partner who depends on your income

- Want to leave money to your heirs through life insurance.

If you fit one or more of these categories, there are a few options to consider.

Buy Another cheap level premium Term Life Insurance Policy

If you still have obligations like mortgage payments or dependents, the best option for most reasonably healthy people is to buy another level premium term life policy. You might have to pay a higher price now that you’re older, but buying a shorter term — such as 5 or 10 years rather than 20 — will help lower the cost.

Shopping around can also pay off. Even if your former insurer offered the best deal when you were searching for your previous policy, another carrier could have the better price this time.

Keep in mind that you’ll probably have to answer health questions and take a life insurance medical exam during the application process.

Take Your Term Life insurance Policies Year By Year

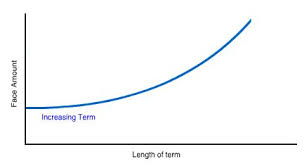

Rather than buying a new 20 term life policy for five or more years, you could opt for annual renewable term life insurance, where you decide each year whether to continue coverage. This may be a good choice if you anticipate only a few more years of major financial obligations. The main drawback is that rates can jump quite a bit each year, making a “level term” policy a better choice for needs that last at least five years, although the most common policy term period is 20 years. Very few companies these days offer five year term life policies. Even fewer companies offer annually renewable term insurance policies these days.

As an alternative, ask your agent if you can extend your current term policy one year at a time. This would let you avoid a new medical exam, but the price jump will be HUGE! It’s not uncommon for the next premium after the level period expires to be more than 5X the current premium. Most people can’t afford those premiums, however, this could also be an option for people with terminal medical conditions who need life insurance at any cost and plan to maintain coverage for only a couple more years.

Convert Your Level Term life insurance Policy To Permanent Life Insurance

Although level premium term life insurance is best for most people, permanent life insurance has certain advantages. Permanent life insurance, as the name implies, lasts the rest of your life. But it also costs much more than term life. Types of permanent policies include whole life and various forms of universal life, including variable life and indexed universal life.

If you still need coverage after your level premium term life insurance policy expires, your carrier may offer the option to convert it to a permanent life insurance policy — which does not require a new medical exam or answering health questions again. You may be able to convert only a portion of the death benefit, however, meaning you’d have a lower benefit once the term policy ended.

If your term insurance policy allows conversion, there will be a deadline for conversion that’s before the end of the policy. There’s also typically an age cutoff for converting, usually age 70, depending on the insurance company. The new permanent life insurance premiums get higher every year you wait to convert. Converting only a portion of the coverage amount to a permanent life insurance policy can save some money.

Buy A New Permanent Life Insurance Policy

If you decide you want to buy permanent life insurance, converting your level premium term life insurance policy may seem like the most convenient way to do it. But if you’re still in good health, it might not be the cheapest route. Be sure to get quotes for a new permanent life insurance policy, too.

Most people who still need life insurance coverage are best off buying a new level premium term life insurance policy. If you’re one of the exceptions, you may want to consult a financial adviser.