5 Ways to make sure that you don’t fall for one of those online term insurance quote scams

You know the ones I’m talking about where you give up a bunch of personal information and 10 life insurance agents ring your phone off the hook in the next 5 hours?

If this has happened to you, then read this to know how to avoid this scam!

When it comes to your life insurance, you can’t afford to waste time with Online Term Life Insurance Quote Scams–bad quotes, unsecured websites and limited choices.

That’s why we’ve assembled our term life insurance engine to be the best option there is to get online life insurance rates.

In under 30 seconds, we’ll deliver you free quotes from 40 top life insurance companies, for example, reliable names like MetLife|BrightHouse, Prudential, and Lincoln Financial Group.

Our quote engine is secure and fast, allowing you to find the coverage you want easily. Once you’ve checked it out, using it is ABSOLUTELY fast and easy!

There are some fantastic quote engines online, but some are not worth your time at all. To make sure the site you are visiting using is LEGIT, here are some tips to follow:

First, let’s establish what exactly quote engines do and what to look for so you can avoid online life insurance quote scams

The objective of an engine is to show one of the best prices on life insurance, narrowed by your own personal medical history and requirements.

This will be your personal demographic information like your sex, whether or not you have a history of tobacco usage, along with your date of birth.

Next, you’ll be asked what type of life insurance you’re looking for, providing alternatives for the duration, coverage type and the general amount you’d love to be insured for.

Once you’ve entered this information, the quotation engine will give you quotations from various companies, giving you a good notion of what to expect from such companies when applying for their coverage.

There are many term insurance quote engines online that will give you an expert, accurate quote absolutely free. Paying for one is an absolute waste of money and, frankly, dishonest since this is public information.

1. NEVER Pay For The Use Of A Term Insurance Quote Engine!

2. In the event the website asks you for information such as your name, email address or phone number, make sure it’s a secure website, otherwise, it could be an online term life insurance quote scam.

3. Take a critical look at the life insurance companies the term insurance quote engine provides you. If you do not understand any of those listed companies, do some research on them.

4. It’s preferable to get a wide number of life insurance companies in your results. Unless your life insurance needs are extremely unique, you should be getting a variety of term insurance quotes right from the quote engine. If you’re not, it merely means that the term insurance quote engine recognizes a problem with your input and wants you to discuss your case with an agent.

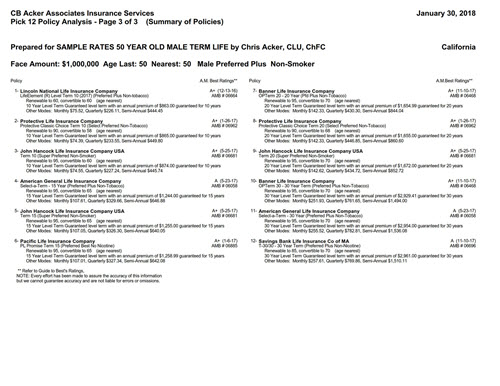

5. Finally, make sure that the term insurance quotes you get are specific to you and not a generic pre-formatted grid. See the image below for a great sample of term life rates for a male age 50

If the engine only provides you with 5 year age brackets, for example, that really will not help you choose a policy. Those numbers could be way off, and a life insurance company’s rates could be much lower or much, much higher. It’s not hard to get life insurance quotes online. But with a wide range like that, there are sure to be choices which are poor, flawed, or even a blatant scam.