Update for November 2021:

U.S. life insurers are paying out far fewer Covid-19 death claims than initially expected, largely because the virus is disproportionately killing people with little to no insurance.

In the past few weeks, many life-insurance companies have sharply reduced estimates of their exposure, as measured by payouts per 100,000 U.S. Covid-19 fatalities. Estimates have come down by an average of 40% to 50%, according to Credit Suisse stock analyst Andrew Kligerman.

Driving the rapid reduction in exposure are two groups: older Americans and minorities.

Older people often have smaller policies than people who are still in the workforce. The latter typically buy policies to protect spouses and children against the loss of a breadwinner’s income, aiming to cover home mortgages and fund college tuition. Based on data through mid-September, the federal Centers for Disease Control and Prevention calculates that approximately four-fifths of U.S. deaths involving Covid-19 have been of people at least 65 years old. Its current total shows just over 200,000 total U.S. deaths.

Courtesy Wall Street Journal Sept 2020

The year 2020 will be one that we all remember. We’re living history right now. Experts predict that this COVID-19 illness will leave no one untouched. From the most robust industry to the tiniest infant, it will find us all. But what does that honestly mean?

This post takes a deep dive into the life insurance industry and how the coronavirus is impacting it. We’ll answer questions about what’s really going on behind the scenes and whether or not a minuscule virus molecule will take down our behemoth insurance market.

COVID-19: What You Should Know

Before we begin, let’s give this novel virus the stage for introductions. After all, it’s better to keep your friends close and your enemies closer. The new SARS-CoV-2 is the coronavirus causing the often deadly respiratory disease COVID-19.

The highly contagious family of coronaviruses is widespread in both people and several species of animals. It’s not too far off from MERS or SARS in likeness or origin as they all originated in bats. To learn more about the science behind it and more in-depth information about the coronavirus, visit the Centers for Disease Control and Prevention (CDC) website.

Not only has the COVID-19 disease infected more than two million people worldwide, but it has claimed over 170,000 lives to date—and counting. Unlike other viruses, none of us have a built-up or natural immunity to this strain. It’s so severe that entire countries have restricted social movement and halted workforce development, issuing shelter-in-place guidelines, or otherwise known as “lockdown.”

Source: India Today Group

Most people around the globe are coming to accept how severe COVID-19 genuinely is. Since it’s spread via sputum, social gathering places, such as grocery stores, are filled with mask-wearing individuals — a rare site in everyday America. It’s safe to say that this virus forever changes our lives.

However, what many of us are wondering is how all of this influences our economy. Will we experience another recession? Who will survive financially, and who won’t? Will there be anyone to bail us out? What part will the insurance industry play?

And more specifically, what part will life insurance play, and how is the life insurance industry being impacted by COVID-19?

How COVID-19 Is Impacting Life Insurance Now

Unlike other fragile and fast-paced industries, such as the restaurant business, most insurance carriers are tanks. They move slow and steadily. Think about the tortoise and the hare; we’re the tortoise, of course.

That said, it takes a lot to derail the insurance industry — but COVID-19 is “a lot.”

The good news is that, according to Insurance News Net, “it’s business as usual for insurance carriers.” Still, amid the coronavirus pandemic, things are changing in the way we complete tasks. For now, most of these changes are temporary, but you should know what’s honestly going on nevertheless.

Delayed Medical Exams

Generally, life insurance applications call for medicals exams to jumpstart the applicants’ policy. These off-site exams typically include a blood test, routine screening, urine analysis, physical examination, and detailed questions about family medical history.

Since COVID-19 is incredibly contagious, the high risk of sending a representative to examine a potentially infected individual is dissuading most insurance carriers against the idea of off-site exams. Instead, some carriers are forgoing medical exams altogether.

Longer Grace Period

Many times, insurers allow a 30-day grace period for insureds to renew their coverage. This approach gives people a chance to catch-up on tasks they’d previously placed on the back burner, such as renewing their policy.

That said, most life insurance policies don’t require an annual renewal as an auto or business plan would. However, insureds must keep up on their premium payments to prevent their life insurance policies from lapsing.

Because of the financial challenges that the coronavirus has created with furloughs, layoffs, and business closures, not to mention the social distancing guidelines, life insurance carriers are taking a new approach. Insurers are attempting to continue business operations through alternate models — telephone, emails, video chats, etc. — and aren’t disrupting or canceling service.

Slowed Medical Records

Doctor’s offices have never been known for the speed of delivering medical records to clients or other medical offices. Requests tend to take their sweet time, and for the most part, we’ve come to accept this fact.

However, the coronavirus pandemic has bottlenecked the delivery of medical records even more than usual. Since many offices don’t have what they consider non-essential office staff working, some tasks are taking longer than expected. In short, getting medical records is problematic.

Naturally, the delay in getting medical records is causing delays in processing life insurance applications, as well. Though, insurance carriers are finding ways to work around the issue, mostly by focussing on other portions of the application first.

More Profound Involvement

Some life insurance carriers across the globe, such as LIAM in Malaysia, are providing additional assistance to those who’ve been inflicted with COVID-19. And the extra relief measures couldn’t have come at a better time.

In Ghana, insurers have vowed to continue providing services to their patrons during the lockdown period. Not only will these measures provide individuals — customers, staff, and agents — with COVID-19 insurance coverage at no cost. Some are also waiving pandemic exclusions and the waiting period on policies if COVID-19 causes death.

Other ways insurers are bringing relief during the pandemic include:

- Simplifying claims procedures

- Allowing their customers to use WhatsApp to file claims

- Establishing dedicated claims teams

- Enabling customers to purchase insurance digitally

- Providing more training and incentives to agents

Sufficient Capital

All across the world, people are dying from this deadly new virus — with or without life insurance. Some individuals believe that the number of deaths will be too much for the insurance industry to handle. The fear is facing too many losses and too many claims without enough money for insurance payouts.

Although this pandemic is undoubtedly challenging the industry, it won’t beat it. Rest assured, insurance carriers worldwide have sufficient capital to “take a hit,” per se. According to ABS-CBN News, Benedicto Sison, CEO of Sun Life Financial Philippines and President of the Philippine Life Insurance Association said, “I am very confident in saying the life insurance industry is sufficiently capitalized to serve claims of this epidemic.”

Life Insurance Landscape: What to Expect

COVID-19 has had the power to stop many individuals and businesses from continuing their daily routine. Lives and workflows have been severely disrupted in the U.S. and all over the world. So, it’s no surprise that many people are wondering whether the new coronavirus is a game-changer for the insurance industry.

The short answer is maybe.

Insurance expert and professor at Moore School of Business, Robert Hartwig, chimes in, “It’s unlikely that the current pandemic fundamentally restructures the insurance industry, at least in terms of property/liability and life insurance.”

Still, it’s worth examining how COVID-19 will influence the reshaping of the insurance industry.

Tightening of Guidelines

The insurance industry is a market based on risk. It weighs the vulnerabilities and then balances those exposures with sufficient underwriting guidelines, protecting itself against insolvency or shuttering. That said, it only makes sense for the industry to tighten up the guidelines because of the novel virus.

Keep in mind that those with current life insurance plans won’t see any changes to their active policy. However, a director with A.M. Best, Thomas Rosendale tells Forbes that he “expects carriers to implement underwriting procedures designed to identify applicants who have either contracted or been exposed to the COVID-19 virus.”

Some experts say to move quickly and get a policy now before qualifications become more stringent and premiums increase to accommodate a decline in financial markets. Others say to conduct your life as you regularly would.

We saw what fear and panic could motivate people to do — toilet paper, anyone? So, being scared into buying a random life insurance policy isn’t anyone’s idea of sound decision-making skills. A better approach would be to weigh your options alongside a knowledgeable insurance professional so that you land on the right life insurance plan for you and your family.

More Exclusion Riders

In other countries prone to viral epidemics, mostly those without adequate healthcare, pandemic exclusionary riders aren’t uncommon. After all, so much disease and death have the potential to skyrocket financial damage for insurance carriers. But let’s back up; an exclusionary rider is a carve-out on an insurance policy, barring that loss from being covered.

Since the COVID-19 death toll has been so high, one rumor circulating is that some insurance carriers are considering adding exclusionary riders on new policies, preventing COVID-19 deaths from being covered. Erin Ardleigh, founder and president of Dynama Insurance, said, “I have not seen a policy that has a carve-out or an exclusion for a pandemic.” However, she did recommend reviewing life insurance plans and beefing up coverage if necessary.

Even Policy Genius brings some comfort to this matter, “While some life insurance policies have exclusions for specific causes of death — like if you were to die while doing a high-risk activity or in an act of war, there is no pandemic exclusion for life insurance.”

Paused Policy Issuance

Much like the rest of the business world, insurance carriers aren’t entirely sure how to handle the COVID-19 crisis. As mentioned, the insurance industry works by assessing risk — but the virus is so new that there isn’t a history of statistics to go by. What this means is that we insurance folks are playing a guessing game.

Some insurance carriers might pause policy issuance temporarily until they find their pandemic footing. Mostly, this will influence seniors and those individuals with current health issues. Carriers who do suspend life insurance acceptance will likely resume when a vaccine is available, or potentially sooner.

Overhaul of Risk Model

Lastly, a significant way that the COVID-19 crisis will impact the life insurance landscape is that it will change the way carriers evaluate and underwrite policies. Naturally, this approach will vary from carrier to carrier, forcing each insurer to rework their risk models with the limited COVID-19 data.

To sum up LSM Insurance predictions, some insurance carriers will take a more conservative approach by excluding individuals with respiratory pre-conditions. Also, other carriers will resort to outpricing specific groups — putting a hefty price tag on particular policies — to dissuade them from purchasing a plan from that carrier.

An Uptick in “Fluidless” Underwriting

With social distancing becoming the new norm, who’s to say how our everyday lives will look in six months or even a year. Insurance carriers aren’t counting on one-on-one encounters with strangers to be acceptable any time soon. As a result, previously required procedures, such as medical exams, are flying out the window.

In many cases, a new standard is replacing the old one: “fluidless” accelerated underwriting, which forgoes the traditional medical exam during the application process.

What Is “Fluidless” Accelerated Underwriting?

Some say that accelerated underwriting has been all the rage for quite some time, while others argue that it’s just now picking up traction. The funny thing is, both are true.

Fluidless accelerated underwriting has been around for years, but because of the troubling times, it’s quickly becoming a go-to for many insurance carriers. Mainly because of the option to fast-track applications to approval status.

This streamlined approach to underwriting gives applicants a chance at approval and coverage without the standard medical exam and lab. Hence the name “fluidless” — no pricks or pokes for this plan.

As imagined, approved applicants must fall within a particular face amount as well as age and underwriting class limitations. However, when it works out, it’s a win-win situation — and it works out frequently, too.

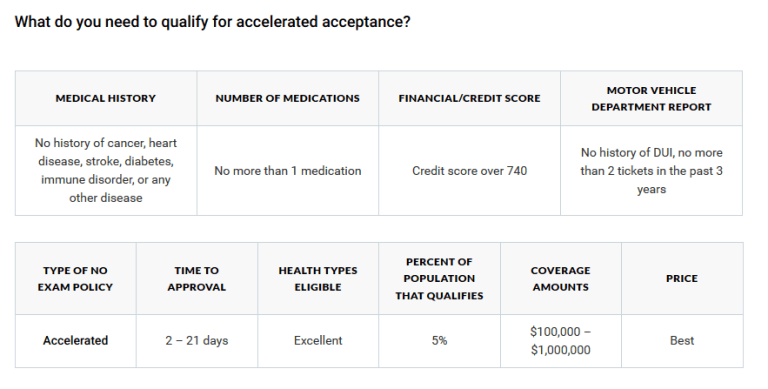

According to Life Insurance for Parents, below are some of the typical qualifications you might see to qualify for fluidless accelerated underwriting.

Source: Life Insurance for Parents

Understanding Your “Fluidless” Options

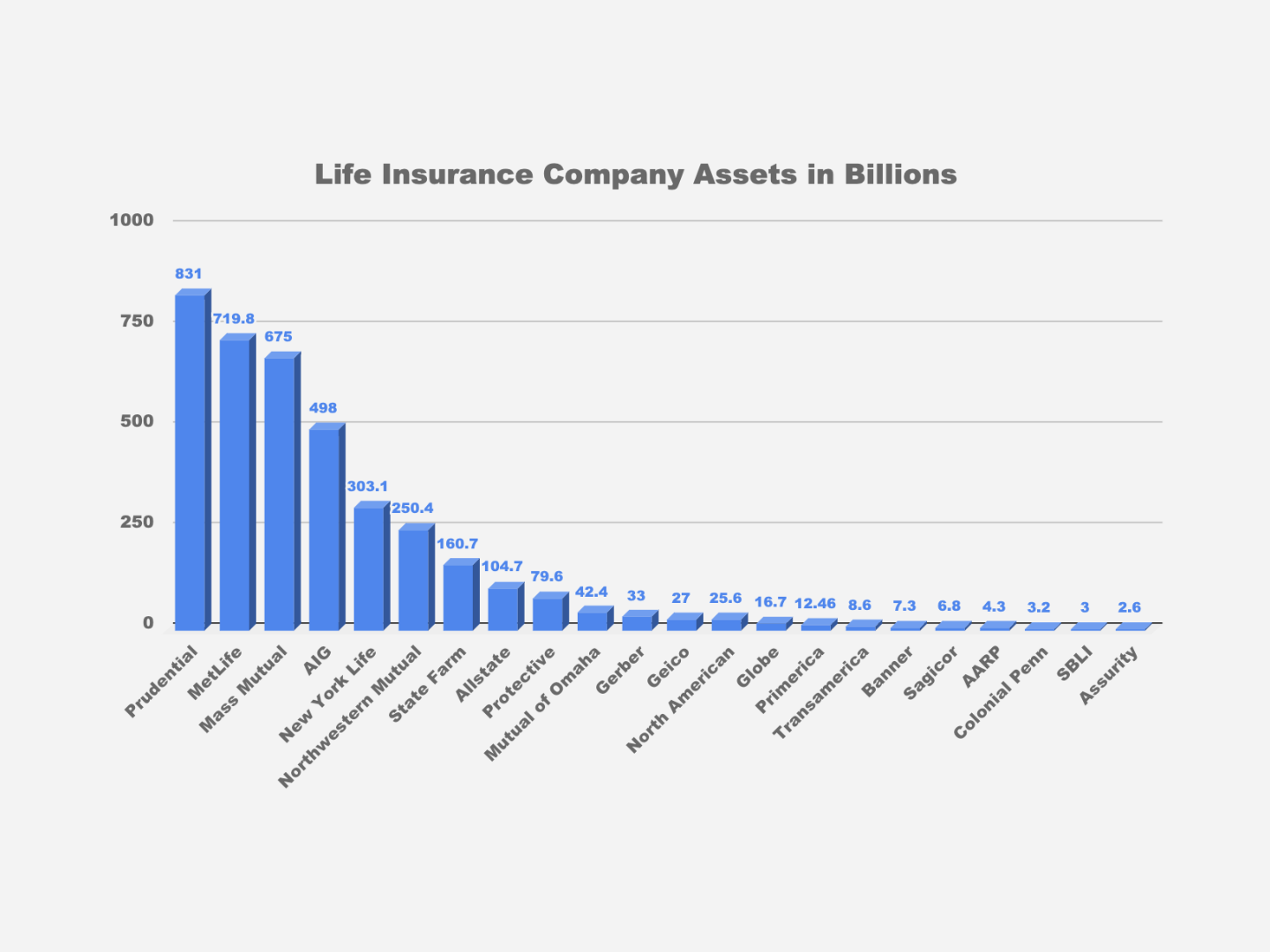

Not all insurance carriers offer accelerated underwriting, but many of the top-rated companies do. For example, here is a curated list of insurers who provide this type of underwriting, including their financial security and ranking in the industry.

Source: NoExam.com

From experiencing what we all now know as “lockdown,” the benefits of accelerated underwriting make more sense. It’s easy, quick, and bypasses a face-to-face medical exam. For applicants, the downside of this process is merely not meeting qualifications. And for insurers, the vulnerability lies in an applicant’s ability to disclose personal information.

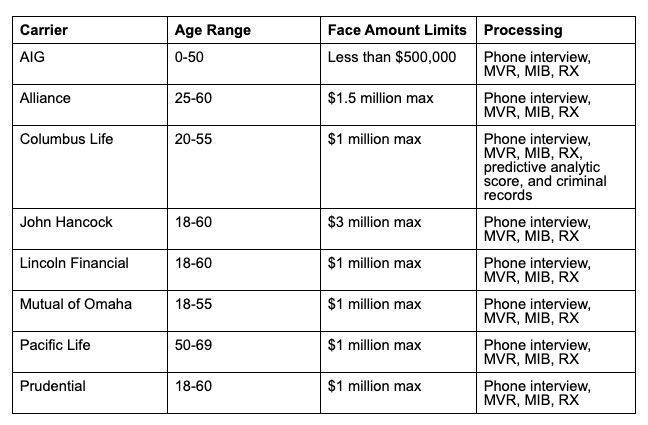

Nevertheless, both parties are embracing this streamlined process as outlined below:

For a more comprehensive list of participating insurers, please visit: First American Insurance Underwriters

Will the Coronavirus Botch Your Life Insurance Application?

As it stands, it’s unlikely that the coronavirus will make a mess of your life insurance application — but there are a few things you should know before you dive in headfirst. Firstly, the insurance industry is on the same pins and needles as the rest of the professional world. Nobody knows the future; we merely prepare the best we can with the knowledge we have.

Some insurers are taking precautionary measures, such as postponing policy issuance and also asking virus-related questions during the application process. And it only makes sense as none of us honestly know how this novel virus will impact the human body down the road.

As mentioned, COVID-19 might end up being an exclusion, or it might be a severely uncomfortable blip in our history. That said, let’s talk about what to expect when you apply for life insurance nowadays.

Prepare to Answer Coronavirus-related Questions

According to Forbes, insurance experts say to get ready to answer a slew of questions related to the coronavirus when applying for life insurance, such as:

- Have you been exposed to it?

- Is your health back to normal after recovering from the illness?

- What medical treatment did you receive?

If you’ve been exposed to the virus, some insurers will postpone your application for at least 30 days. This approach is also valid if you’ve been diagnosed with COVID-19. In this situation, you will be reconsidered for a policy when you can prove that your health is back to your regular baseline.

Keep in mind that COVID-19 has only been a household name for a handful of months. What this means is that not all insurers will include the disease in their guidelines. However, expect more carriers to start asking about your history with it.

Be Honest About Your Health

As mentioned above, fluidless accelerated underwriting leans heavily on how honest applicants are regarding their personal information. When it comes to insurance, though, honesty is the best policy — because your sins will find you out in the end, unfortunately.

When asked if you’ve been tested or treated for the coronavirus, tell the truth. Besides, the insurer will most likely require you to sign a statement noting that there haven’t been any changes to your health status during the application process. If you fudge your health information, you run the risk of losing the policy altogether.

Disclose Travel Plans

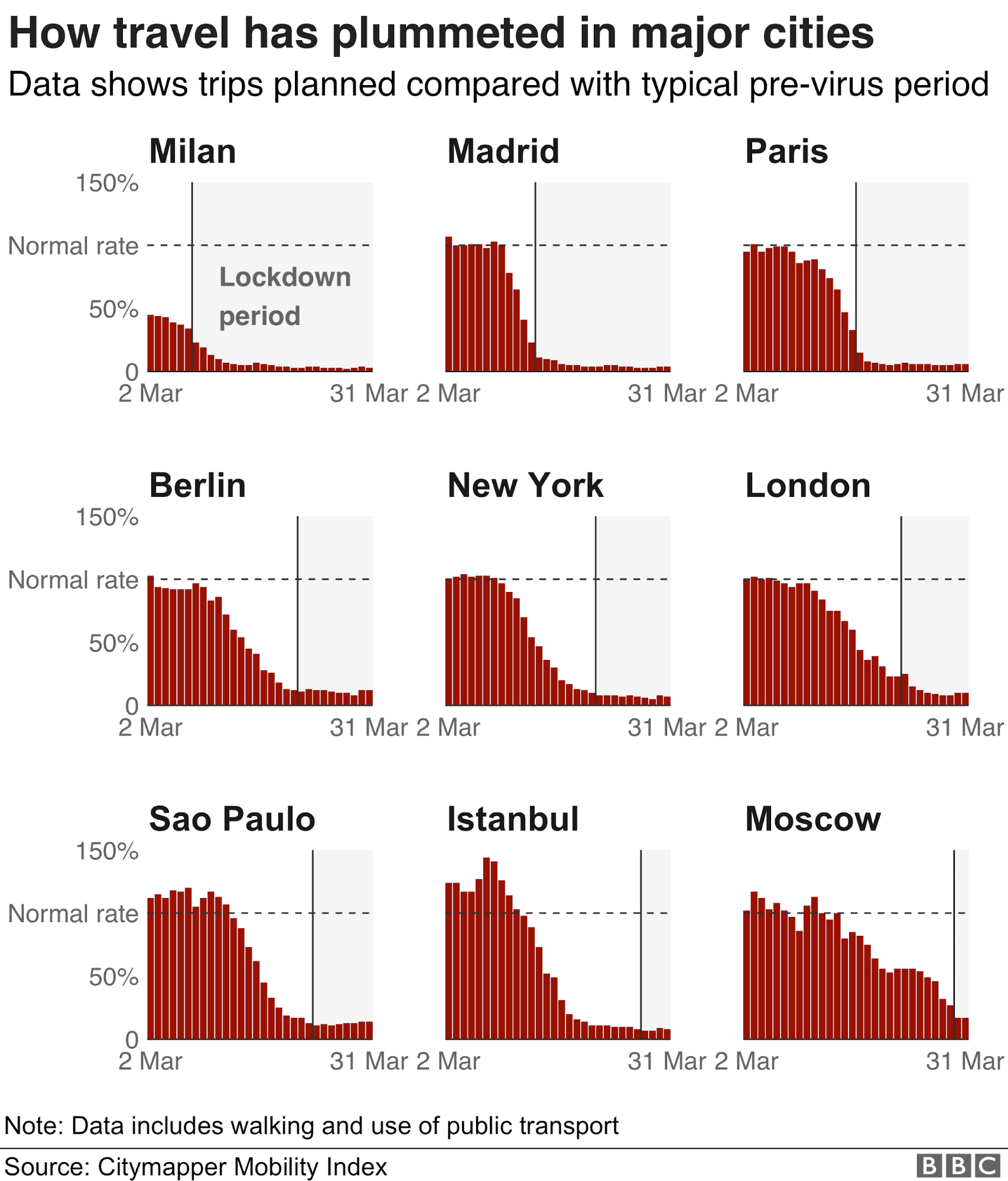

Although we still see air travel occurring, many of those planes are only partially filled with passengers — if at all. It’s safe to say that COVID-19 has thrown travel, in general, an excruciating left hook. As outlined below, travel has plummeted in major cities:

Reports show that the virus landed on our shores via overseas travel. In attempts to prevent its spread, travel has all but halted. Still, expect insurers to ask about your recent travel history and your travel plans.

Furthermore, according to BBC News, if you’re returning from a COVID-19 “hot spot,” your application might be delayed by 30 days. Mostly, insurers want some assurance that you’ve not been infected during your travels.

Opt for a Shorter Term Policy

Since the COVID-19 outbreak, medical exams are no longer the gold standard in the life insurance application process. Instead, insurers are opting for a varied and unique approach to underwriting, including fluidless underwriting.

As a result, many insurers are pushing applicants toward different policies. Bob Bland, CEO of LifeQuotes, explains, “We’re kinda being forced into recommending a shorter-term no-exam [policy], such as ten years, with the thought of getting a lower cost exam-required plan at a later date.”

To sum up, try to be open to a shorter-term policy if you’re shopping around for life insurance nowadays. You’re more likely to get approval for it.

Does Life Insurance Cover COVID-19?

It’s the question on many people’s minds right now: does life insurance cover COVID-19?

Nicholas Mancuso, manager of the disability and advanced planning team at Policygenius offers comfort, “But if you already have life insurance, and you die from coronavirus, your beneficiary will still receive the survivor benefit.”

As mentioned, COVID-19 doesn’t change any active life insurance policies you have. And pandemic exclusions aren’t standard in the United States. So, it would be nearly impossible for an active life insurance policy not to cover this particular disease — but let’s set a few records straight.

Debunking “Force Majeure” Clause

Some situations bring boilerplate contract language to the forefront, including the COVID-19 crisis. The “Force Majeure” clause is one provision in particular about which insurers are receiving numerous inquiries. According to the National Law Review, this specific clause “excuses a party’s performance of its obligations under the contract when certain circumstances arise beyond the party’s control.”

Typically called force majeure events, these include:

- Epidemics or pandemics

- War

- Terrorist attacks

- “Acts of God”

- Famine

- Strikes

- Fire

Most insurers are confirming that the Force Majeure clause will not apply in COVID-19 death claims. Mainly this clause impacts commercial policies; however, failing to pay your life insurance premium could count as a contractual obligation. Every carrier is different, so it’s essential to be aware of your contract language.

Get Temporary Coverage

Even when fluidless accelerated coverage speeds up the application process from 4-8 weeks to a couple of days, waiting might still occur with other policy applications. Understand that you do have the option of getting temporary coverage — limited life insurance coverage — while you wait out the pending application period.

Don’t Invalidate Your Policy in Contestability Period

Typically, the first two years after you buy your policy serve as the contestability period. During this time, life insurance carriers can revisit any misreported information (i.e., travel plans, health status, etc.). If the insurer discovers that you withheld any information, you and your beneficiaries might be out of luck.

For example, perhaps you tell the insurer that you won’t travel to a particular area in the world, such as a COVID-19 epicenter. But then you do. Not only that, but you also contract the illness in question (COVID-19), and pass away from it. In this situation, an insurer can refuse to pay out the death benefit to beneficiaries.

Remember, though, during the contestability period is when carriers conduct the most investigations. Any significant mishap and carriers might begin to question your intent.

Understand the Long-term Health Impact

Not even the most intelligent among us know for sure how COVID-19 will impact an individual’s body in years to come. Maybe it will merely exit our system like an annoying cold. Or perhaps, its symptoms will regularly reappear on random days as they do for those who’ve fought off mononucleosis (mono).

Nonetheless, respiratory illnesses tend to hang around, impacting our overall health for the long haul. The coronavirus could behave similarly. We just don’t know.

It’s up to us to accept that COVID-19 might not be contained in just a few weeks of symptoms. The virus could very well cause long-term health concerns, even after making a full recovery. As a result, life insurance carriers could be forced to dole out lower health classifications to those who’ve been inflicted with the disease.

Time will tell how COVID-19 will impact each of our lives. For now, the insurance industry is chugging at a steady pace, preparing to face this era with vitality and strength.

Take the Next Step

It’s tough knowing how to protect your family after you’re gone, especially facing such unprecedented times — but we can help!

To support you as you safeguard your financial security, I’ve created an up-to-date guide for individuals who need life insurance here. My guide can help you with your long-term life insurance goals, especially with a family to nurture at home.

Here at CB Acker Associates, we want to help you take care of your family. If you’re ready to find a policy that fits your needs and your budget, we can help!

With access to all the top-rated life insurance companies, we work extra hard to get you the best life insurance rates possible. You can even compare rates and benefits from over 40 providers with no obligation to buy here. Plus, it’s fast — under 60 seconds kind of fast.

Please, give us a call today at 650-969-5844 or email [email protected].