By now, you’ve likely come to terms with life insurance policies having different purposes. Maybe knowing the difference between whole and term life insurance was a lifelong endeavor—but you’ve mastered it now! To keep you on your toes, though, this post will add into the mix another type of term policy: decreasing term life insurance.

From savings components to cash value to the guaranteed death benefit, each policy plays a unique role. Here’s what you need to know about decreasing term life insurance and whether it’s right for you.

What Is Decreasing Term Life Insurance?

When it comes to a decreasing term life insurance definition, most people toss it into the term policy pile. However, it’s not the same as a level term life insurance—whose premiums stay the same throughout the policy.

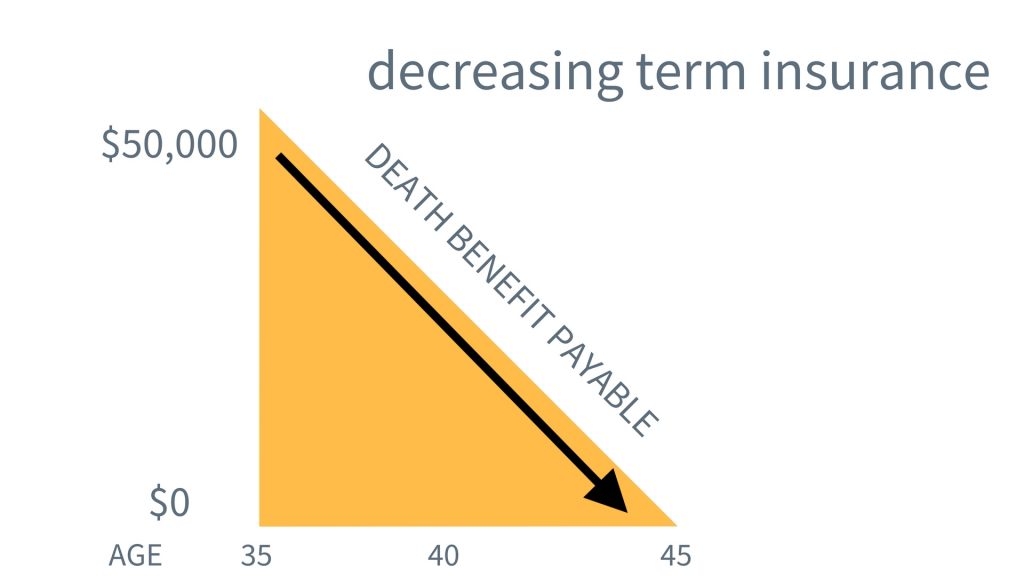

Instead, decreasing term life insurance provides coverage that shrinks over the life of the policy. In other words, the premiums remain the same, while the death benefit decreases at a predetermined rate.

Keep in mind that coverage typically decreases every month or even annually. There aren’t massive financial cliffs to surprise you, of course. That said, many people compare the shrinking steps to a mortgage amortization schedule.

And, of course, like other life insurance plans, decreasing term life insurance usually offers term ranges from one to thirty years. So at the beginning of the policy, for example, your death benefit might be $600,000 and only $100,000 in the last years of the policy. But you’ll pay the same premium the whole time.

Seem a little odd or even backward? Let’s talk about how this type of insurance policy works.

How Does Decreasing Term Life Insurance Work?

Most term life insurance policies have a set premium and feature a fixed death benefit throughout the life of the policy. But a decreasing term life insurance policy doesn’t follow suit. Instead, this particular policy features a steady premium even as the death benefit lowers monthly.

Consider a Loan Schedule

For example, consider all the moving parts of a mortgage amortization schedule. The mortgage payment typically stays the same while the principal and the interest amounts change over time. A decreasing term life insurance policy is not unlike this schedule—but instead of a decreasing loan amount, the death benefit shrinks.

A policy that starts with a death benefit of $200,000 could only have a payout of $50,000 by year five of the policy. Yet, the premium never changes. Of course, how quickly the death benefit decreases depends on how you set up your policy from the start.

Decreasing Term Life Insurance Rates

Keep in mind, as a person ages, the risk to insure them increases. A decreasing term life insurance policy makes up for this exposure by decreasing the death benefit. Still, this insurance—like most term life insurance—is far more affordable than whole life, universal life, or variable universal life.

While it might seem backward to approach life insurance this way, it can serve a purpose in various situations.

What Are the Benefits of Decreasing Term Life Insurance?

It’s tricky to know who sells decreasing term life insurance since only a handful of insurance companies offer it. As a result, most people don’t typically consider it when shopping around for life insurance. What’s more, is that it doesn’t make sense for many people.

Unlike term life insurance—a favorite of financial gurus, such as Dave Ramsey, Suzi Orman, and Clark Howard—decreasing term life insurance only fits a few situations well.

“Mortgage Insurance”

If you’ve heard of decreasing term life insurance before this post, you’ve likely known it as mortgage protection insurance (MPI). Although it’s different from private mortgage insurance (PMI), which protects the lender if you foreclose on the house, it functions similarly.

However, “mortgage insurance” as it’s otherwise known, is purchased through your bank, and the death benefit is paid directly to the mortgage company. Often, a bank will offer it when you take out your mortgage.

While decreasing term life insurance is often used to protect personal assets, you don’t necessarily have to get the policy from the bank. Nevertheless, it could work in this situation because you can match how fast the death benefit decreases with your unpaid loan amount.

Startup Strategy

Another common use for decreasing term life insurance is personal asset protection. Many entrepreneurs and founders go this route when they join forces with a partner to launch a startup business.

Founders use this policy to protect indebtedness against necessary startup costs and daily operational expenses. If one founding partner dies, the death benefit will help cover the cost of continued operations or the deceased partner’s part of any unpaid loans.

Many times, entrepreneurs can land a much more affordable commercial loan when they have the backing of a decreasing term life insurance policy.

Are There Alternatives to Decreasing Term Life Insurance?

As with most things in life, there are other ways to accomplish the same thing as a decreasing term life insurance policy. Here are a few popular alternatives.

Stack Term Life Insurance Policies

When you need to cover a mortgage or a commercial loan, consider stacking term life insurance policies. This approach is also called the “life insurance ladder strategy.” Not only will it save you money on your premiums, but it will protect you just as well, if not better, than decreasing term life insurance.

An example is that you could purchase three policies with varying amounts and term lengths. When the shortest and most significant policy term is up, your mortgage should match the value of the remaining policies. Instead of keeping the same premium, you get to drop the expired premium and only focus on the other two policies.

Decrease the Face Value of the Term Level Policy

Another trending alternative is merely to reduce the face value of your policy as you pay down the loan. An excellent benefit to this strategy is that your premium will decrease as you lower the policy’s face value, too.

Take the Next Step

It’s tough knowing how to protect your family after you’re gone, especially with such a vast amount of information out there. But we can help!

To support you as you safeguard your financial security, I’ve created an up-to-date guide for parents who need life insurance here. My guide can help you with your long term life insurance goals, especially with a family to nurture at home.

Here at CB Acker Associates, we want to help you take care of your family. If you’re ready to find a policy that fits your needs and your budget, we can help!

With access to all the top-rated life insurance companies, we work extra hard to get you the best life insurance rates possible. You can even compare rates and benefits from over 40 providers with no obligation to buy here. Plus, it’s fast—under 60 seconds kind of fast.

Please, give us a call today at 650-969-5844 or email [email protected].