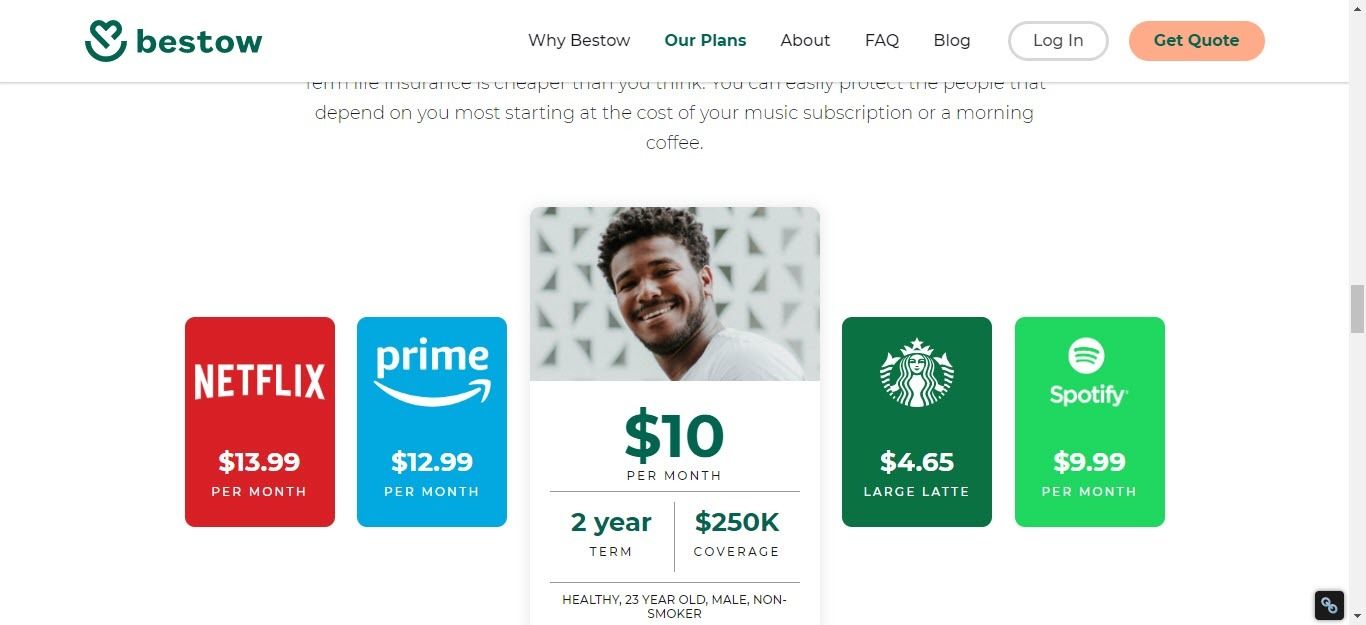

Photo Credit: Bestow Life

Who Is Bestow insurance

Bestow Insurance is a newer online marketer of term life insurance, founded in 2016.

They offer several different flavors of term life insurance policies issued by North American life Insurance Company. Here’s more information on NALIC in the image below.

Photo: NALIC

The business has produced a streamlined application process which can be done in minutes, without the need for a medical examination like several other providers in the life insurance industry.

understanding the basics

Life insurance is the foundation of any sound budget, although not many people prefer hate life insurance and would prefer to have their teeth pulled before they talk about it.

However, having life insurance in place can help you safeguard your nearest and dearest from the financial risk that can arise with your death.

Life insurance death benefits can be utilized to pay any debt or expense, including final expenses like cremation or burial and paying off a mortgage or other consumer debt.

Some beneficiaries decide to use life insurance to replace a family’s income so that they can maintain the same lifestyle without financial hardship.

Bestow Insurance Overview

Bestow Insurance began as a conversation between Jonathan Abelmann and Melbourne O’Banion, both entrepreneurs and fathers, who started the company in 2016.

They wanted to help families get the vital life insurance protection they need without the hassle of the traditional life insurance model.

You know the model I mean- where an agent comes to your house and tries to sell you a whole life policy you probably don’t need or want!

Bestow offers an ultra short-term two year life insurance plan as well as 10 and 20 year term life options without a medical exam or complex underwriting process.

Its two-year plans allow you to obtain coverage through life transitions while you take more time to find out your long-term demands.

If you think you know how much life insurance you’ll need and would like to lock in a low price now, you can select between 10 or 20 years.

Bestow Insurance is known because of its quick online application that may be completed — and approved — in just minutes.

Bestow Insurance, headquartered in Dallas, Texas, takes a more modern approach to life insurance, which offers a streamlined application experience without a health exam.

How Much Does Bestow Life Insurance Cost?

The cost of life insurance policy with Bestow or any insurance provider depends on different aspects.

All applicants are asked about their date of birth, state of residence, smoking status (either non-smoker or smoker), along with other basic details about their medical history.

Based on these replies, life insurance underwriters determine your eligibility and premium.

The entire amount of coverage you want plays a role, together with higher numbers costing more even for its healthiest applicants.

Bestow Insurance reviews these variables with each application it receives.

Although no medical exam is needed, Bestow utilizes an algorithm to ascertain an applicant’s risk before it supplies an estimate for monthly payments.

By way of example, the monthly premium for a healthy 37-year old female who doesn’t smoke could be about $6 for a two-year policy with a $100,000 death benefit.

A 25-year old male with $150,000 two-year term plan would pay around $12 per month.

For a 40-year old male who doesn’t smoke and needs a $1 million policy for 20 years, Bestow quotes a monthly price as low as $43 per month.

Bestow Life Insurance policies offer a two-year term life policy

With this policy, applicants receive a two-year term coverage ranging from $50,000 up to $500,000 in coverage.

Bestow’s 2-year plan is a decent plan for those who are interested in finding temporary, protection or who have needs for less life insurance over the next couple of years.

Personally, I’ve never seen an instance where a client would want anything less than 10 years of coverage.

Bestow insurance also has 10- or 20-year programs with coverage ranging from $50,000 to $1 million.

These policies are more popular among families and individuals who want coverage for an extended period to pay larger financial needs, such as a mortgage balance or prospective college costs for minor children.

With each policy option, the policy premiums are fixed for the length of the term.

There are no add-ons offered or exclusive features that cost more each month.

Nor are there any choices for permanent coverage such as whole or universal life insurance.

Requirements to get Bestow Insurance

There’s not any medical exam required to get a Bestow Insurance policy, but other prerequisites apply.

Applicants need to be between the ages of 21 and 55 to be eligible for coverage and have to be in relatively good health.

Your job, earnings, and any present life insurance policy coverage you own will also impact your eligibility.

Where is Bestow Insurance Available?

Bestow currently offers life insurance nationally, excluding New York.

Presently, Bestow includes a Better Business Bureau (BBB) rating of A, which is solid.

So, is Bestow Insurance Right for You?

Bestow Life Insurance might be a wise option for people who are searching for easy-to-access term life insurance policies.

If you’re young and in a hurry, Bestow is not a bad option per se. I would, ideally, recommend that you look for an online life insurance broker who offers North American term life insurance products as well as many others.

After 35 years in the business, I’m reluctant to recommend a single-carrier life insurance solution.

After all, where will Bestow send you to get insurance if you turn out to be high-risk?

The short application, combined with the brief health questionnaire and no medical examination, makes it effortless for applicants to get the life insurance they need, as long as they meet eligibility requirements.

bestow might not be the best fit

Because Bestow only offers 3 durations of term life policies: 2 year, 10-year, and 20- year level term plans, it might not be a perfect match for everyone, especially if you have health issues.

People looking for other types of Insurance, like a whole life policy or even a universal life policy, have to appear elsewhere for policy.

It’s always a good idea to get life insurance quotes in a couple of different life insurance companies to compare coverage and pricing before making a final choice.

what happens if i’m declined by Bestow?

Not much, I’m afraid. If you look at the Bestow Insurance FAQ page about being declined, you’ll get this short answer:

I was declined, do I have other options?

Yes! Even if Bestow isn’t a good fit for you, it’s important to provide coverage for your loved ones. There are other life insurance products outside of Bestow that could provide you the coverage you’re looking for.

You’re on your own if you’ve been declined by Bestow Insurance (photo: Bestow)

So, as a specialized independent broker, we have a TON of options for you if you’re not in perfect health! We won’t leave you hanging!

Take The Next Step

Knowing more about Bestow Insurance can help you understand the world of online life insurance brokers.

If you’re ready to talk about your own life insurance needs call us. We’d love to chat with you!

To support you as you safeguard your family’s financial security, I’ve created an up-to-date guide for parents who need life insurance.

My guide can help you with your long term life insurance goals, especially with little kids at home!

Here at CB Acker Associates, we want to help you take care of your family.

If you’re ready to find a policy that fits your needs and your budget, we can help!

With access to all the top-rated life insurance companies, we work extra hard to get you the best life insurance rates possible.

You can even compare prices and benefits from over 40 providers with no obligation to buy here.

Plus, it’s fast—under 60 seconds kind of fast.

[email protected].