sleep apnea life insurance for women

My Name Is Chris Acker, CLU, ChFC. I Was Diagnosed With Mild OSA In 2004. My AHI Without Treatment Was 23. I Started Using CPAP In 2004 And My Life Changed! My New BIPAP Device Measures My AHI At About 2.5 Each Night. my life insurance company now loves me since i’m CPAP compliant! let me help you get the best sleep apnea life insurance for women!

My wife hates my CPAP machine! Actually, she hates my mask which has a loud exhaust. I’m constantly playing with my CPAP mask trying to find the absolute best fit!

I actually LOVE my CPAP and wouldn’t go anywhere without it. Recently I’ve been researching sleep apnea in women and how OSA correlates to higher life insurance premiums for both men and women. While it’s possible to get excellent term insurance premiums for women who have sleep apnea, you need to understand the differences between the sleep habits of men and women and also the symptoms and treatment of sleep apnea in women which are quite different than those in men.

You came here looking for sleep apnea life insurance for women, but you need to understand your OSA condition and how OSA affects your personal health and sleep habits.

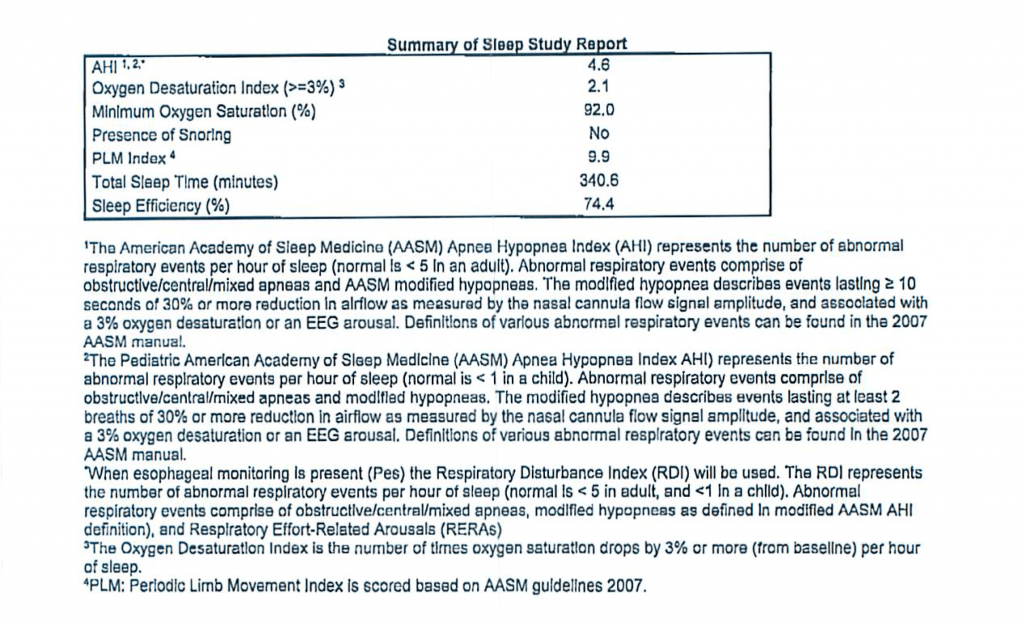

Once you know where you stand regarding you own symptoms and OSA treatment/management, then we’ll get into some of the finer points on presenting a life insurance application to a specific life insurance carrier who specializes in sleep apnea life insurance for women So, take a look at the Quick navigation guide and you can skip down to the section that interests you the most. Remember, We have extensive experience reviewing sleep apnea test results and how those AHI/RDI numbers can influence a life insurance policy offer. Later on, I’ll show you my sleep study summary and discuss approaches we take with our clients when we submit a life insurance case to the insurance company.

Quick Navigation

Sleep apnea life insurance for women

Sleep apnea in women

Can you die from sleep apnea?

Why life insurance companies love women, but hate sleep apnea

CPAP treatment for sleep apnea can boost sex life for women

Menopause, sleep apnea, and life insurance

Use A High Risk Life Insurance Broker to find the best sleep apnea life insurance for women

Your sleep study and sleep apnea life insurance

Sleep apnea in women

Face it, women manifest symptoms of sleep apnea differently than men. Not only do women snore less, but their body types also outwardly don’t adhere to the sleep apnea myth that you need to be a fat middle aged man to be a prime candidate for OSA.

Women who have OSA may:

- Have a large Neck circumference- greater than 16 inches

- Experience daytime fatigue

- Have a lack of energy or excessive sleepiness despite getting an adequate amount of sleep (usually 7-8 hours) at night

- Notice headaches when they first awaken.

- Bed partner may report that they have heavy snoring, or that they have breathing pauses during their sleep and make choking sounds sometimes with these.

- Notice that they have frequent unexplained awakenings at night

- Awaken frequently to urinate

- Awaken from sleep at night feeling as if they are gasping or choking.

- Fibromyalgia

- Hypothyroidism

- Hypertension unable to control by medication easily

Under-diagnosis and misdiagnosis for women with sleep apnea– Doctors can get it wrong

Sleep apnea in women often disguises itself as other serious issues. It’s not uncommon for medical professionals to look for other illnesses before they land on a sleep apnea diagnosis. This is extremely important when you’re shopping for sleep apnea life insurance for women.

Here are some of the common incorrect diagnoses women can labelled with on their way to being correctly diagnosed an treated for OSA. [Correct diagnosis of sleep apnea for women will make a huge difference in lowering women’s life insurance premiums even with sleep apnea].

Typically, women with sleep apnea have these symptoms– (either some or all):

- Anemia

- Cardiac or pulmonary illnesses

- Depression

- Diabetes

- Fatigue from overwork

- Fibromyalgia

- Hypertension

- Hypochondria

- Hypothyroidism

- Insomnia

- Menopausal changes

- Obesity

When it comes to reporting sleep troubles women are much more likely to discuss their sleep problems with their primary care providers. Unfortunately, because of a combination of factors, women with sleep apnea are often diagnosed and treated for other sleep disorders or get treated for comorbid conditions that are typical for sleep apnea patients.

“It is commonly known within the sleep field that women with OSA present differently than men,” Says Angie Randazzo, Behavioral Sleep Medicine Specialist at St. Lukes Sleep Medicine & Research Center, “They often don’t have the stereotypical body type and don’t always say they are sleepy. Many will say they are fatigued, leading clinicians to think they have insomnia versus OSA.”

Can you die from sleep apnea?

Short answer- YES! It’s subtle and a semantic issue, like saying someone can die from HIV. You don’t actually die from the HIV condition itself, rather you die from other side effects caused by sleep apnea. Take a look at some of the recent celebrity deaths where OSA played a significant role in their premature deaths.

Here’s a list of celebrity sleep apnea deaths from The American Sleep Association:

- Carrie Fisher- died 2017. Many speculate that she had a heart attack as a result of untreated sleep apnea.

- James Gandolfini (The Sopranos)

- Comedic actor John Candy

- Justin Tennison (The Deadliest Catch)

- Entertainer Harris Glenn Milstead (also known as Divine)

- Grateful Dead front man Jerry Garcia

- Singer-musician Israel Kamakawiwo’ole

- President William Howard Taft

- NFL player Reggie White

You can see that these actors, entertainers, and professional athletes were mostly men, AND most were obese. The lone woman on this list was Carrie Fisher and she was not obese, yet she suffered a fatal heart attack, which was her listed cause of death.

Why life insurance companies love women, but hate sleep apnea

Typically, women pay less for life insurance than men. This is a simple fact. However, when you throw in a sleep apnea diagnosis, women tend to be more difficult to underwrite for this condition, in my experience. All of the co-morbidity factors mentioned above make it difficult for a home office life insurance underwriter to sift through mountains of medical records accompanied with you life insurance application. This is precisely why you, as a woman with sleep apnea, need to make sure that you apply with the insurance company that will be the most aggressive and flexible viewing your special sleep apnea condition. Sleep apnea life insurance for women is a specialty in which not all life insurance carriers are fluent.

Older obese women, age 50-70, are 31% more likely to have OSA than non-obese women. Women with OSA are also more prone to developing other serious condition, especially mental health issues such as anxiety and depression. These medical conditions can lead a life insurance company to decide to decline a woman’s life insurance application if she suffers from sleep apnea.

7 Steps women with sleep apnea can take so you can get the best term life policy

- Identify your symptoms. Talk with your sleep partner to see if they recognize any of the symptoms described.

- If you do suspect a sleep disorder, get an appointment with your primary care physician. Discuss a possible sleep apnea condition. She should be able to refer you to a sleep medicine specialist.

- Go see a sleep medicine specialist and ask for an initial sleep study. With the Affordable Care Act, sleep studies are now cheaper to patients than ever. Sleep studies are covered like any other office visit, which is awesome because these sleep studies can cost over $3,000 easily without medical insurance.

- Ask if a home sleep study is possible instead of spending the night in a facility. Home studies are not as acutely accurate as facility studies, but they cost far less and are much more convenient, especially if you have young kids at home.

- Meet with your sleep doctor and go over your results. If you have and AHI of over 5 (apnea/hypopnea index- how many times you stop breathing in an hour), then you are considered to have obstructive sleep apnea and treatment is indicated.

- Get the “titration sleep study” done ASAP. This is where you need to spend the night at a sleep center. This would be a second study where the sleep center hooks you up to a CPAP machine and dials in your proper CPAP pressure settings.

- Meet with the sleep doctor again and they will recommend a durable medical equipment provider where you can get your equipment fitted and provisioned with the exact pressure settings you require. This is all done by prescription form the doctor. You can’t simply go and buy a CPAP/BiPAP machine off the street ans self-treat.

CPAP treatment for sleep apnea can boost sex life for women

As if getting the best rates on sleep apnea life insurance for women isn’t enough incentive for all you women reading this, there’s new research in the sleep disorder field that suggests that CPAP therapy for OSA/CSA can actually help your libido. It’s true! According to a new randomized study of men and women who are being treat for OSA, the study published in the May 2018 edition of the JAMA Network Otolaryngology- Head and Neck, subjects who were treated with CPAP for sleep apnea reported increased libido. While not entirely devoted to women, the results of the study showed overwhelming imporvement of “sexual quality of life” for women. In men, not so much… Sorry guys! However, the JAMA report goes on to say that men who are being treated with positive airway pressure for sleep apnea should certainly continue its use.

Menopause, sleep apnea, and life insurance

Ok, now comes the fun part for women seeking life insurance! Women of middle go through menopause. Typical symptoms include night sweats for no apparent reason. BUT, did you know that night sweats during menopause can mean that you might have sleep apnea? This issue has been research heaviliy recently and, according to the National Sleep Foundation:

“Generally, post-menopausal women are less satisfied with their sleep and as many as 61% report insomnia symptoms. Snoring has also been found to be more common and severe in post-menopausal women. Snoring, along with pauses or gasps in breathing are signs of a more serious sleep disorder, obstructive sleep apnea (OSA).”

So, you see, there’s a big connection between sleep apnea and menopause. Seems like many sleep disorders manifest themselves during peri-menopause and post-menopause and life insurance companies will want to see your medical records to make sure that you’ve reported these conditions to you primary care physician and that any treatment has been recommended, like CPAP or oral appliances. For women, sleep apnea simply hasn’t been a primary diagnosis because most endocrinologists and gynecologists are focused on the hormonal effects of menopause. Snoring could be your first clue that your sleep pattern has changed.

Another concern that life insurance carriers have with underwriting a life insurance policy with sleep apnea is that sleep problems are often accompanied by depression and anxiety. With these mental health issues comes an increased risk of suicide and other co-morbidity factors which underwriters would add a surcharge or “policy rating“. This can add significantly to the premium you pay.

So, ladies, don’t ignore those night sweats and snoring if you sleep partner complains to you. You will both sleep better if you seek a medical opinion and sleep apnea life insurance for women wont be an issue!

Use A High Risk Life Insurance Broker to find the best sleep apnea life insurance for women

Once you get your treatment set up and you have a few weeks of CPAP therapy under your belt, you’re ready to go to a life insurance carrier to see if they would offer a life insurance policy. On this front, you need to use a special risk life insurance broker who has solid experience with women and sleep apnea life insurance. The worst thing you can do when you are looking for sleep apnea life insurance for women is to go to a “captive” agent for a single life insurance company. Those agents do not have the ability to shop your sleep apnea case to many different carriers. They owe their allegiance to that specific life insurance company and that carrier may or may not be good at underwriting sleep apnea life insurance policies. A good sleep apnea life insurance broker will be able to help present your case to the insurance carrier in the best possible light. I will say, that since I have been treated for OSA since 2004, I am uniquely qualified to help clients get the best possible sleep apnea insurance rate classification.

Your sleep study and sleep apnea life insurance

I’ve included a copy of my most recent sleep study from Stanford Sleep Medicne done in 2014 below. This was a “titration study” performed so I could update my CPAP equipment. The medical insurance carriers do require follow up studies be done periodically. In my case, I have been using the same CPAP machine for about 6 years. I can tell you that the new CPAP/BiPAP machines are amazing and life insurance carriers LOVE the CPAP telemetry feature where you get a “mini” study every night. My average AHI readings on my new CPAP/BiPAP is roughly 2.5-2.9 which is essentially a normal reading. If you haven’t updated your CPAP equipment, definitely do so ASAP. The life insurance carrier may in fact give you a better rate just for updating your sleep apnea equipment.