Is Sleep Apnea A Disability?

If you suffer from sleep apnea and are searching for life insurance, then this post is for you! Here you’ll learn how and whether life insurance underwriters consider sleep apnea a disability or not. Armed with this important information, you be able to CRUSH the application process and get the lowest possible term insurance-all with in-depth knowledge you’ll get in this article.

Keep reading…

(Buy the way, if you’re unsure whether you have sleep apnea, you can still use this information packed article to help you in your sleep apnea life insurance quest!)

This post will fill you in on how to understand insurance ratings, revealing the inside scoop on an underwriter’s job and how they determine if sleep apnea is a disability, or not… Let’s dive in!

Getting the most out of something means understanding how it works, right?

For example, when your vehicle isn’t running correctly, you pop the hood (or, hire someone to do it). And, if your main dinner dish isn’t tasting the way you want, you examine the recipe.

Before any action, there’s a good chance you’re cocking your head to the side, squinting your eyes, and asking a very valid question to pinpoint the weak link in your endeavor.

Well, getting excellent term insurance rates is no different.

And the question to ask… “Is sleep apnea a disability?” The second question is undoubtedly whether or not you have the power to change that categorization.

To get the best term insurance rate, it’s vital to know the challenges you face.

Understanding the Role of an Underwriter

Firstly, let’s talk about the person who holds the epic stamp of approval for your term insurance application.

An underwriter’s role is to decide whether to provide insurance and under what terms. In their process of evaluating your application, they’ll determine your premium, and coverage amounts as well.

You need to convince an underwriter you’re worth covering. Also, when asking, “Is sleep apnea a disability?”- You’re asking the underwriter this…

In some cases, an underwriter will consider your sleep apnea a disability. However, in other cases, they won’t. And believe it or not, neither your doctor nor the Social Security Administration determines this.

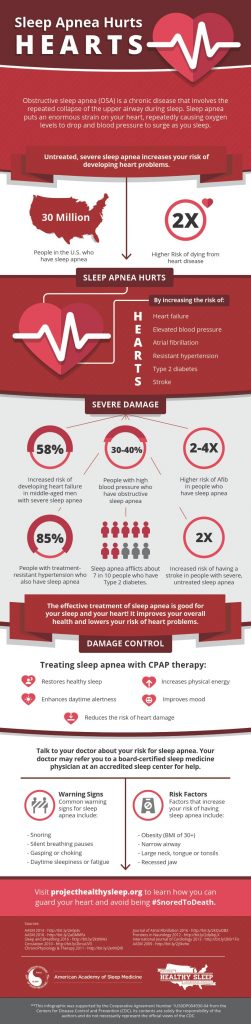

Left untreated, Sleep Apnea causes all kinds of illnesses and diseases. Untreated or poorly managed Obstructive Sleep Apnea would most likely be deemed a disability.

Nevertheless, an underwriter is looking at your health, health management, and health history through a freshly cleaned microscope lens. If they perceive something about you as “risky,” you’ll likely get assigned a higher premium.

Which stinks.

But, you don’t have to settle. Keeping staring under the hood or examining that recipe. Your “aha” moment is coming.

Acknowledge Your Co-Morbidity Factors

In eyewear terms, underwriters sport “co-morbidity glasses” rather than rose-colored lenses or anything whimsical.

In other words, they have eagle eyes for factors that indicate your health may cut your life short. Which, would leave your insurance company paying out on a term policy.

Underwriters are looking at factors such as weight, heart issues, cholesterol, high blood pressure, and whether you’re a smoker. Remember, they’re also asking, “Is sleep apnea a disability for this person?”

And, they’re coming to a conclusion based on length of the condition, severity, and other health issues possibly caused by your sleep apnea. Usually, they arrive at these conclusions by having you undergo a sleep study test.

From this fine-tuned assessment of your application, an underwriter will assign a rating to you.

Is sleep apnea a disability-How You’re Rated

Think of a rating as a grade. Although being graded is in no way glamorous, it’s a valid description of insurance ratings.

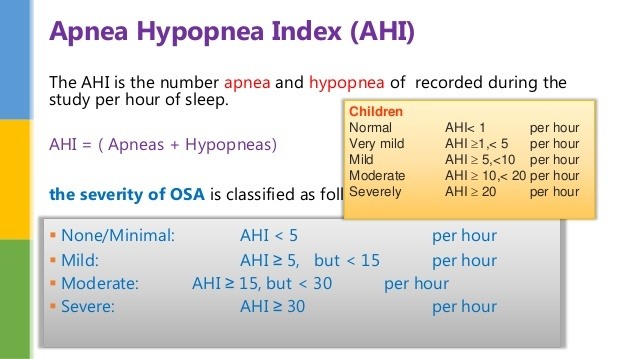

As mentioned before, you’ll likely undergo a sleep study test. From this test, an underwriter is looking at two key elements:

- Oxygen Saturation

- The Apnea-Hypopnea Index (AHI)

To break these items down, the AHI measures your pauses in breathing while the oxygen saturation calculates shallow breathing.

Normal oxygen saturation—the balance of oxygen in your blood—for a healthy person is 95-100 percent. Your AHI has an index value ranging from 0-30+. Of course, lower numbers indicate a better AHI.

Ultimately, it’s this sleep study test that will be the determining factor for an underwriter. While your doctor may assign you with “moderate to severe” sleep apnea, for example, the sleep study test may indicate “mild to non-existent.”

What Your “Ratings” Mean

As you may have guessed, the worse the rating, the more likely an underwriter will view your condition as a disability.

So, is sleep apnea a disability?

The answer is yes; it can be.

As mentioned before, aside from the sleep test, an underwriter will be considering your overall health concerning ratings. A frequently overlooked key to outsmart ratings is how you manage your health.

So when you ask, “Is sleep apnea a disability for me?” don’t be surprised when my response prods a little into how you’re managing your health.

With that said, consider these basic life insurance classifications:

- Preferred Best/SuperPreferred: Reserved for people with optimal health and no increased health risks, think marathon runners and Dr Dean Ornish practitioners.

- Preferred: Typically assigned to those with excellent health who also deal with a few minor problems such as elevated cholesterol levels.

- Standard Plus: People in this category have optimal health but commonly struggle with more significant health issues such as being overweight or high blood pressure.

- Standard: Assigned to people with average health and an average life expectancy, but co-morbidity factors such as early parental death or minor health problems play a huge role.

- Preferred Smoker: Otherwise falling into the regular preferred category, this is for those who smoke (occasional smoking or cigar smoking often included).

- Standard Smoker: Reserved for people in the standard category who also smoke.

As well as the above categories, there are table ratings for individuals who don’t fit into any of these slots. Unsurprisingly, table ratings also carry the highest premiums.

Here’s the Good News if you’re still asking, “is sleep apnea a disability”

Although sleep apnea can be considered a disability, you also have some say in the matter. By adjusting your lifestyle and managing your health better you can essentially show an underwriter you’re not as “risky” a client as they previously believed.

Now, life isn’t always in our hands or as malleable as clay. So, your best bet of winning the best term insurance rate is to apply through a broker. An educated one, at that!

A broker isn’t tied to one single life insurance company. Therefore, they can shop around for the best rates for you.

When you take actionable steps to improve your health— dieting, exercise, CPAP compliance, etc.— a seasoned broker will be able to get you the best rates to fit your life.

So, is sleep apnea a disability for you? If you believe it is then stay tuned for my next blog post about how to outsmart an underwriter.

In the meantime, please check out my helpful Buyer’s Resource Guide for more tips and information on how to get the lowest cost term insurance when you struggle with sleep apnea.

If you’re ready to get a top term insurance rate and a better understanding on elements impacting your rate, reach out today either by phone at 650-969-5844 or email [email protected].